Super Micro Computer: Riding the AI Wave Alongside Nvidia’s Dominance

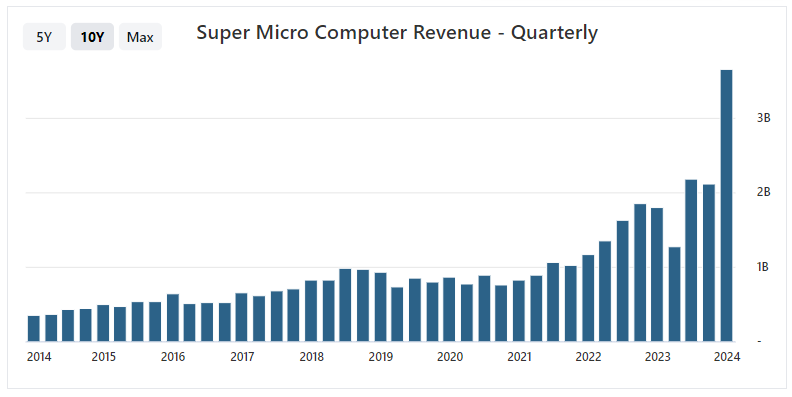

Super Micro Computer (NASDAQ: SMCI), a tech infrastructure company, has risen prominently as a primary beneficiary of burgeoning interest in AI investments. With its stock soaring over 900% in the past year prior to a recent downturn, it has outstripped even Nvidia’s performance.

So, what exactly does Super Micro Computer do?

SMCI serves as an infrastructure provider across various sectors, including AI, cloud computing, 5G, and edge computing. Their product range includes complete servers, storage systems, modular blade servers, blades, and similar equipment. However, the primary catalyst for SMCI’s growth has been the accelerated development of AI solutions and the increasing demand for computing power and infrastructure.

What are positive catalysts for this company?

Rising demand for computing power and data storage

Recent breakthroughs in AI technology necessitate significant increases in computing capabilities and data storage capacities. Big tech companies alone committing approximately $170 billion in 2024 towards AI initiatives, specifically targeting data center expansions and related. And chipmakers such as Nvidia and server infrastructure firms like SMCI are primary beneficiaries of this trend.

Competitive advantages

SMCI’s products boast numerous competitive advantages that greatly appeal to its customer base. Particularly noteworthy is the company’s provision of preconfigured, ready-to-deploy AI and high-performance server racks, streamlining deployment processes and reducing complexity. Their modular design approach grants them a cost and time-to-market edge, allowing for swift integration of new technologies.

With the increasing demands of AI driving enhancements in CPU and GPU technologies, power requirements have surged, resulting in higher operating temperatures compared to previous iterations. SMCI’s proprietary liquid-cooling technology addresses this challenge, offering potential electricity cost savings of up to 89% in infrastructure cooling activities and up to 40% in overall data center operations.

Hans Mosesmann, an analyst at Rosenblatt Securities, said he believes one big attraction for customers is Supermicro’s ability to quickly deploy “liquid-cooled racks that uniquely fall into Supermicro’s area of expertise: fast, innovative, green, many SKU’s, U.S.-based, and Lego-like.”

Close partnerships with industry leaders

SMCI’s partnerships with Intel, AMD, and Nvidia guarantee access to cutting-edge technologies and provide support for emerging workloads.

What are the risks?

Margins and Valuation

Both Nvidia and SMCI have tripled their revenue over the past three years, but Nvidia’s gross profit margin in the latest quarter stood at 76%, nearly five times higher than SMCI’s gross margin of 15%. Moreover, Nvidia managed to translate its robust revenue growth into substantial gross profit margin expansion over the past year, while SMCI saw declines in gross profit margins every quarter.

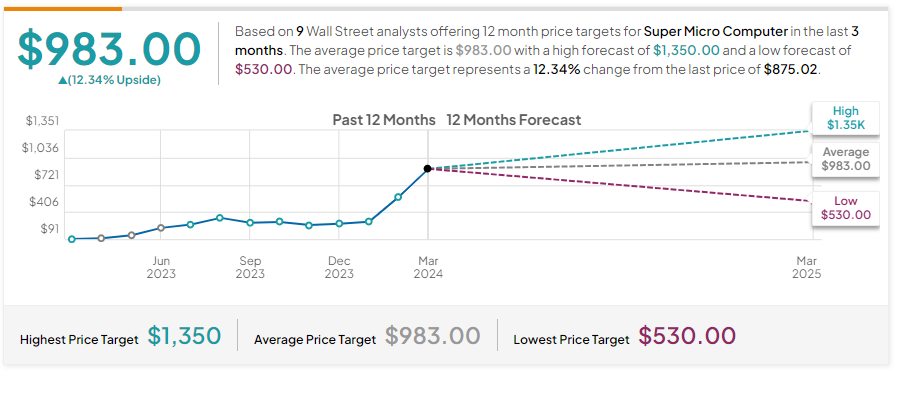

Super Micro’s valuation multiples appear to be stretched, with the recent quadrupling of the stock price over the last two months being primarily attributed to the expansion of earnings multiples. Following the significant rally in SMCI, the stock now appears even more expensive compared to Nvidia.

Competition

The market for SMCI’s products is intensely competitive, constantly evolving, and susceptible to emerging technological advancements and new product launches. In its annual report, SMCI noted an uptick in competition from original design manufacturers leveraging their scale and cost-efficient manufacturing to introduce their own branded products. This suggests a strong likelihood that competitors such as Cisco, Dell, Hewlett-Packard Enterprise, Inspur, and Foxconn may take a share of SMCI’s market sooner or later.

Conclusion

SMCI had a remarkable performance in 2024, surging fourfold fueled by the strength of AI and positive guidance outlined in their Q2 earnings report. However, the rally might have been excessive, and now further fueled by its inclusion in the S&P 500 index, which is sustaining elevated prices. Despite an impressive revenue forecast for Q3, the consecutive declines in margins are concerning. Still, the SMCI’s growth momentum most likelly remain robust in the short term, driven by the escalating demand for AI. Moreover, SMCI possesses a competitive edge in facilitating scalability through its proprietary technologies, a feature particularly appealing to customers focusing on the swift expansion of AI infrastructure.

Dislcaimer: The content of this article is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.